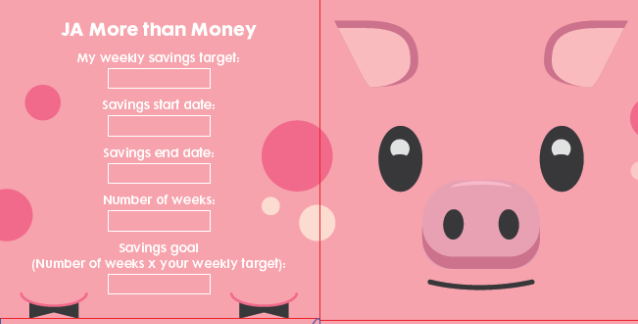

We are proud to announce the winners of the More than Money Savings Challenge Congratulations to these nine winners, determined by a draw at JASA’s head office: Sandile Nkhosi and Kamohelo Magge from Ekuphumeleleni Primary School in Soweto Gauteng; Refiloe Mashoeshoe, Simphiwe Xaba, Joana Janeiro and Thabo Nkalosa from Realeboha Primary in the Free State; […]

Congratulations to the nine More than Money Savings Challenge Winners!