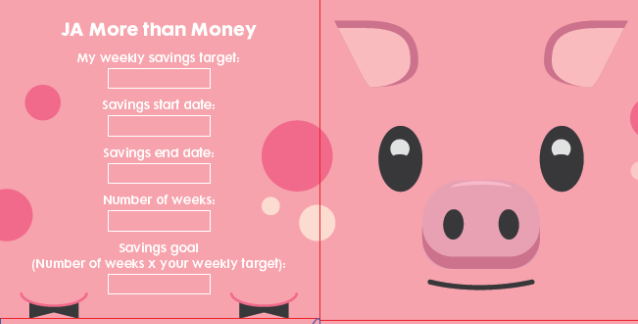

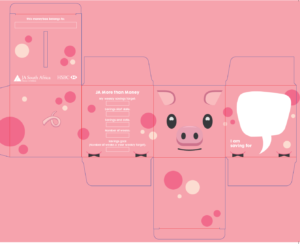

The Savings Challenge is open from this week starting 23 April, 2018, until the end of the winter school holidays on 16 July 2018. Around 5 000 earners participating in the More than Money and More than Money in a Day programmes each receive a cardboard piggy bank and set a target of how much they want to save, based on a weekly target multiplied by the 12 weeks of the challenge.

In the first week after the school holidays they will open their piggy banks with their teachers and count their savings. If they have reached their savings target they are eligible to enter the provincial draws, which will take place on Thursday 26 July 2018, just at the end of Savings Month, at the JASA offices.

A total of nine winners from across the country will be announced after the draw. The winners will need to open bank accounts and JASA will match each winner’s savings from the challenge and deposit this sum into their accounts. (The maximum amount that JASA will match is R2 000.) We would like to track the nine winners over the year that follows to see if they continue to save.

HSBC’s decade-long partnership with JASA

Since the launch of JA More than Money in 2008, globally HSBC Holdings has partnered with JA to sponsor and implement this programme, contributing $14.2 million (USD). In total, more than 579,000 students have been impacted by the program and more than 8,900 HSBC employees have volunteered.

The programme is currently rolled out in more than 30 Junior Achievement member countries worldwide and in 2010, Junior Achievement South Africa won the best practice award for extending the More Than Money experience to the learners’ families through financial literacy focus groups.

Since the inception of this global partnership, JA South Africa and HSBC have collaborated locally over these nine years to reach close to 23,000 grade six and seven learners across the country, in both urban and rural environments.

What does the programme entail?

In partnership with HSBC, the JA More than Money programme teaches Grade 7 students about money-management topics such as earning, saving, and spending as well as entrepreneurship skills. The style of learning is experiential and hands-on.

Learners gain the financial education basics, preparing them to be financially responsible adults who contribute positively to their communities.

At the conclusion of the program’s five, 45-minute sessions, students should be able to:

-

- o Identify the role of money in everyday life.

- o Think like entrepreneurs and identify a small business they can start.

- o Explain the basic steps of starting a business, including why it’s important and its impact on society.

- o Analyse the advantages and disadvantages of borrowing money.

- o Explore the opportunities of global markets.

Each session includes a facilitator-led activity and a game experience to reinforce money-management and entrepreneurship skills learned during the session.

As the financial education landscape continually changes, online tools such as mobile banking and online budgeting have become increasingly prevalent. The updated JA More than Money program recognizes the shift toward technology-based solutions and offers digital resources beyond the classroom, encouraging students to understand emerging technologies from an early age.

The JA More than Money program’s focus on entrepreneurship inspires students to think about small businesses they can create. Throughout five sessions, students learn the fundamentals of starting a small business and developing a business plan. From there, they learn the purpose of financial institutions and explore the opportunities and challenges across global markets.

According to HSBC’s 2017 Essence of Enterprise Report, 25% of entrepreneurs in their 20s say that having a positive economic impact was a factor in their decision to go into business and 23% say they wanted to have a positive impact in their community. The JA More than Money curriculum fosters these aspirations by introducing the foundations of entrepreneurship to students at an early age, including why businesses are important and what their impact is on society.